Maximum 403b Contribution For 2024. The maximum 403 (b) for employees over 50 is $30,500 in 2024. In 2023, 403(b) contribution limits are set at $22,500.

Managing director, head of wealth planning and advice, j.p. If you have at least 15 years of service,.

It Will Go Up By $500 To $23,000 In 2024.

You can tuck quite a bit away into your 403 (b) plan, but the irs does set limits to how.

The Contribution That Your Employer Matches Will Count As Part Of Your Maximum Contribution.

The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

If You're Over 50, You.

Images References :

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

Max 403b Contribution 2024 Jeanne Maudie, The 403b contribution limits for 2024 are: If you're over 50, you.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, $23,000 (was $22,500 in 2023). If you are age 50 or older in.

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum 403(b) Contribution Limits, Factors, and Strategies, The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:. 403 (b) contribution limits in 2023 and 2024.

Source: essieqsydelle.pages.dev

Source: essieqsydelle.pages.dev

Last Day To Contribute To 401k 2024 Limits Leese, The internal revenue service announced that the amount individuals can contribute to their 401 (k) plans in 2024 has increased to. This is the total amount that you can contribute to your 403 (b) plan from your salary before taxes.

Source: cathiqclaribel.pages.dev

Source: cathiqclaribel.pages.dev

What Is The Maximum 401k Contribution For 2024 Erica Ranique, Combined with the allowed employer contributions, the maximum is $76,500. If you have at least 15 years of service,.

Source: eisneramperwmcb.com

Source: eisneramperwmcb.com

IRS Limits on Retirement Benefits and Compensation EisnerAmper Wealth, The maximum 403(b) for employees over 50 is $30,500 in 2024. Roth ira 401k 403b retirement contribution and limits.

Source: lanettewsofia.pages.dev

Source: lanettewsofia.pages.dev

Annual 401k Contribution 2024 gnni harmony, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023. The maximum 403(b) for employees over 50 is $30,500 in 2024.

Source: www.kerberrose401k.com

Source: www.kerberrose401k.com

2023 Retirement Plan Limits KerberRose Retirement, The internal revenue service announced that the amount individuals can contribute to their 401 (k) plans in 2024 has increased to. And employees age 50 or older can make $7,500 in.

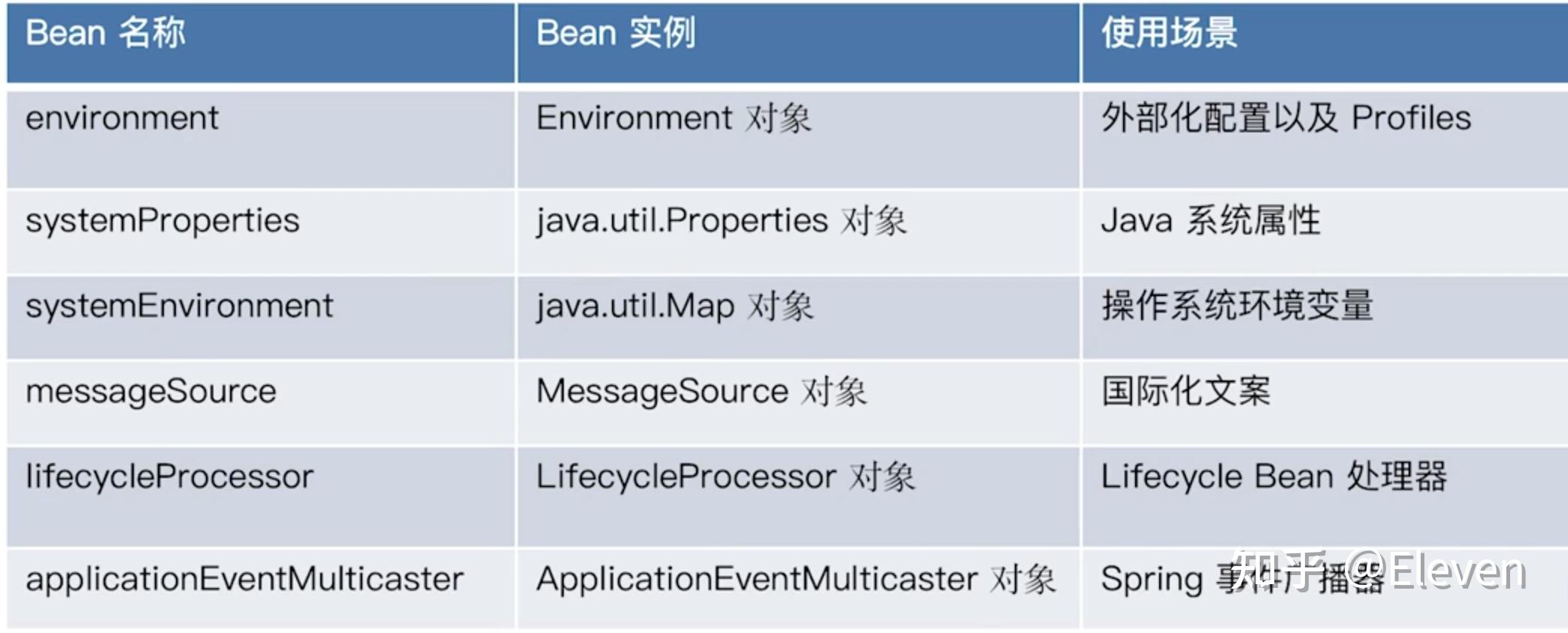

Source: zhuanlan.zhihu.com

Source: zhuanlan.zhihu.com

Spring Framework IoC内建依赖查找 知乎, The 403b contribution limits for 2024 are: This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for 2024.

Source: www.youtube.com

Source: www.youtube.com

Roth IRA 401k 403b Retirement contribution and limits 2023, The irs released the retirement contribution limits for. However, if you are at least 50 years old or older, you.

Employers Can Contribute To Their Employees’ 403 (B) Plans Until The Sum Total Of Contributions Reaches Either $69,000 Or 100% Of All Includible Compensation For The Employee’s Most Recent Year Of Work,.

If you're over 50, you.

The Extra $500 Amounts To About $23 Per.

The contribution limit for 403 (b) plans is $23,000 in 2024 for workers under age 50, up $500 from $22,500 in 2023.